Why your best promotions are falling flat—and it's not what you think.

You've crafted the perfect promotion. The margin math works. The timing is right. The creative looks great. But when it hits the sales floor, something's off. Sales don't pop the way they should. Budtenders seem caught off guard. Customers ask questions your team can't answer.

Sound familiar?

At SparkPlug, we understand that the point of sale is the point of truth. That’s why we surveyed 500+ budtenders across the country to understand what's really happening on the frontlines of cannabis retail promotions. What we found reveals a critical blind spot that's costing brands and retailers millions in lost sales—and it has nothing to do with your promotional strategy.

We set out to discover the missing link between a flawless marketing strategy and disappointing floor performance. The answers weren't in pricing or creative, but in communication. What we uncovered is a systemic failure in how promotional information reaches the sales floor, preventing your most valuable asset, budtenders, from performing at their best.

The Uncomfortable Truth: Your Frontline Is Flying Blind

The problem isn't the deal itself; it's the delivery of information. We found a severe gap between when a promotion is planned and when the person selling it is truly prepared.

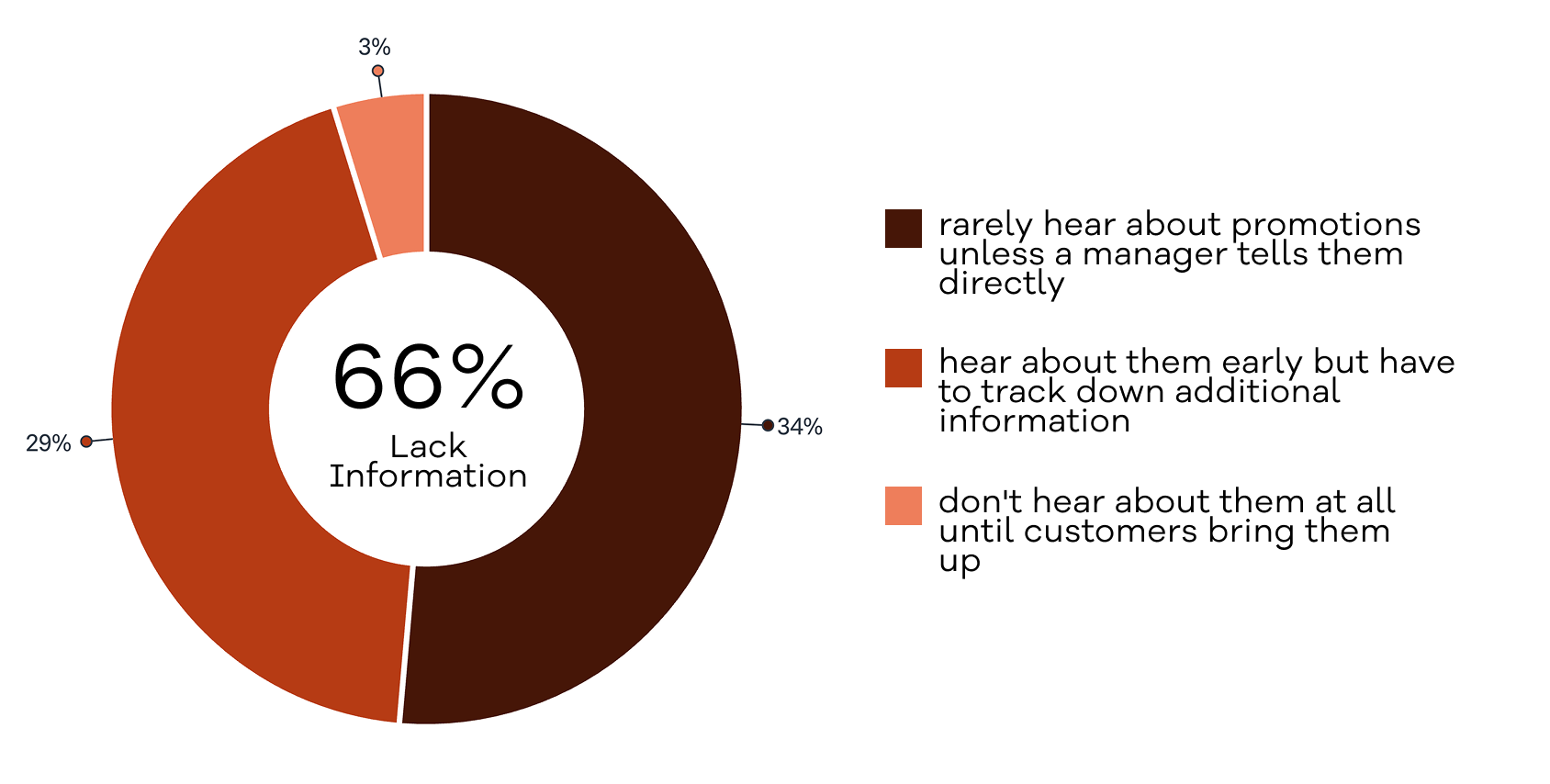

Only 34% of budtenders hear about promotions early with all the details they need.

Let that sink in. Two out of every three budtenders—the people who are supposed to be excited ambassadors for your brand event—are operating without complete information.

Breaking down the other 66%:

-

34% rarely hear about promotions unless a manager tells them directly

-

29% hear about them early but have to track down additional information

-

3% don't hear about them at all until customers bring them up

The Preparedness Problem is Costing You

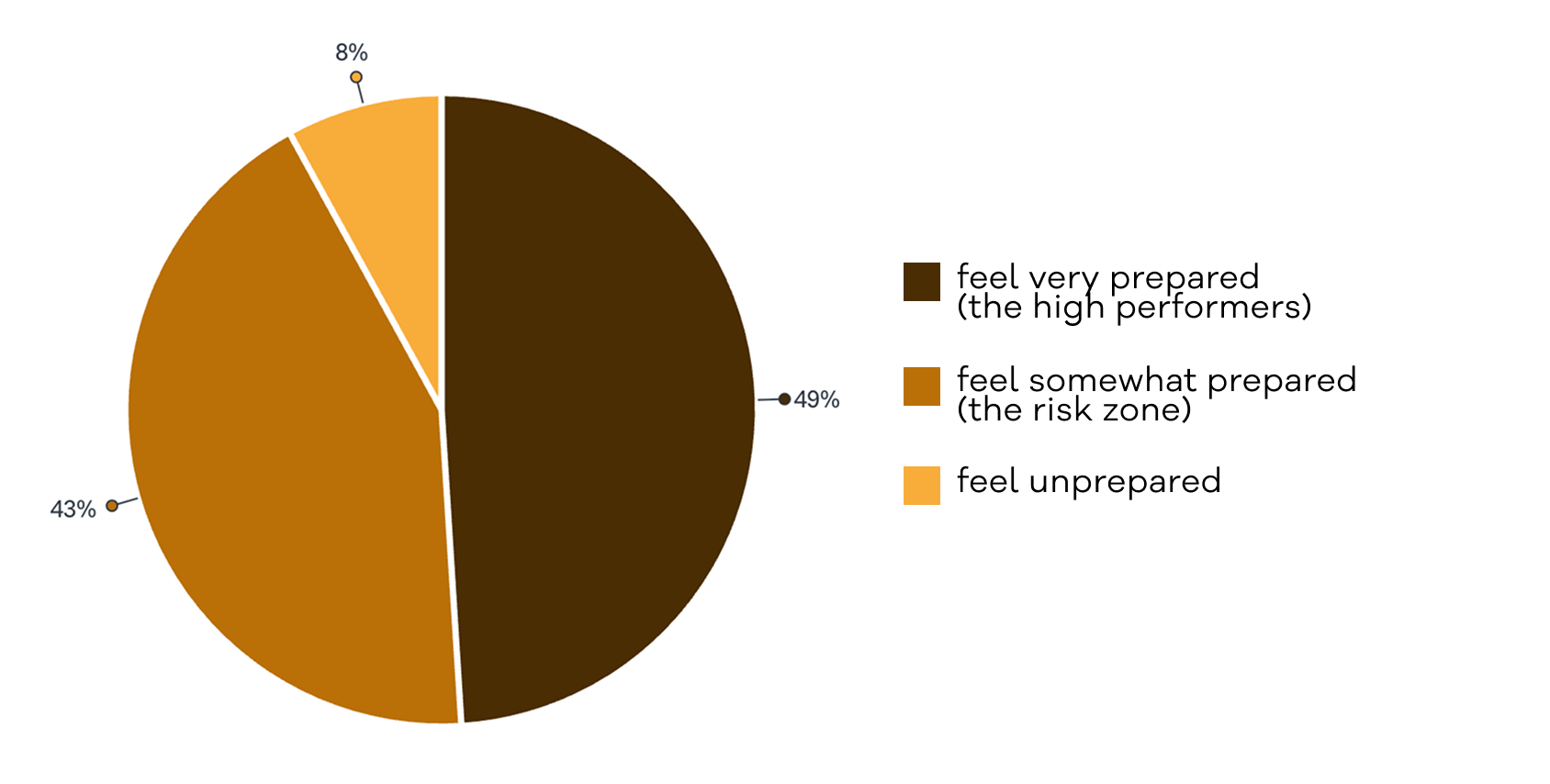

When we asked budtenders how prepared they feel to talk about upcoming promotions, the data revealed a concerning pattern:

-

49% feel very prepared. (The high performers)

-

43% feel "somewhat prepared." (The risk zone)

-

8% feel unprepared.

What Actually Moves Product: Insights from the Frontline

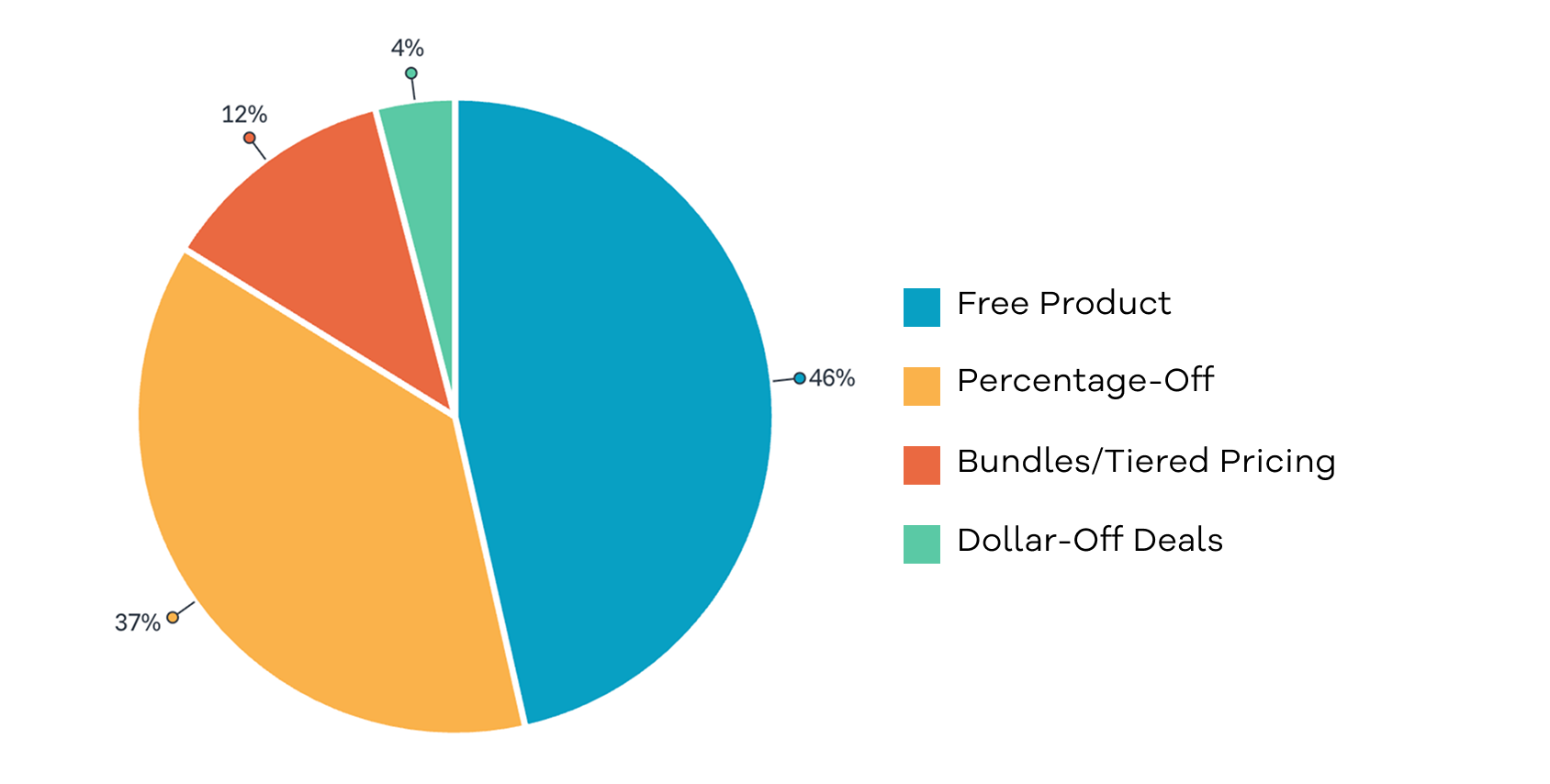

Not all promotions are created equal. When we asked budtenders which promotions generate the biggest sales reactions from customers, here's what drives behavior:

The strategic implication: If you're running complex bundles or tiered pricing (the deals that require the most explanation), you need your budtenders prepared even more than usual. These promotions live or die based on frontline education.

The Communication Breakdown: How Information Currently Flows (Or Doesn't)

Budtenders painted a clear picture of promotional chaos in their open-ended responses:

"We struggle with deals not being active at the store."

"Events/offers occur when the store is actually not stocked on items that pertain to the ongoing event."

"I often don't hear about them at all until customers mention them."

The current system relies on outdated methods: buried email chains, manager-to-staff verbal communication (the telephone game), and physical flyers that rarely make it to the floor. The result? Critical information gets lost in translation, arrives late, or never reaches the people who need it most.

The Notification Solution: What Budtenders Actually Want

We asked budtenders how helpful in-app alerts or SMS reminders would be for remembering upcoming promotions. The response was overwhelming:

-

43% said "highly effective—I'd never miss an event"

-

36% said "effective—it'd help me remember most of the time"

Combined, 79% of budtenders want direct notifications about promotions. They aren't ignoring your promotions by choice. They want to know. They want to be prepared. They’re simply asking for the tools to bridge the communication gap.

What This Means for Your Promotion Strategy

If you're a cannabis brand or retailer, this data should fundamentally change how you approach in-store activations:

-

Lead Time Is Non-Negotiable

Don't announce a promotion three days before it starts and expect magic. Budtenders need at least 7-14 days of advance notice to internalize the details, ask questions, and get excited about selling.

-

Notification > Documentation

Creating a beautiful promotional PDF doesn't matter if it lives in an email that gets opened once. Push information directly to budtenders' phones or the apps they already use daily.

-

Details Matter More Than You Think

Budtenders are asking for:-

Exact product SKUs included

-

Start and end dates/times

-

Specific terms (is it store-wide or certain categories?)

-

Whether inventory is actually in stock

Vague promotions create confusion. Confusion kills conversion.

-

-

Prepare the explanation

Remember: 46% of top-performing promotions are "free gift with purchase" and 37% are percentage-off deals. But if you're running bundles or complex tiers (which require explanation), double down on budtender education. These deals require fluency, not just awareness.

-

Close the Loop

Budtenders told us they want to know if the products and deals are actually live on the POS system. Nothing erodes trust faster than promoting something that turns out to be out of stock or doesn't ring up properly. Confirm that your product is live in-store before asking staff to push it.

What Top-Performing Brands and Retailers Are Doing Differently

The best-performing cannabis operators are treating promotional communication like the revenue driver it is:

- Centralized event calendars that every team member can access

- Automated notifications that reach budtenders directly, not through layers of management

- Real-time updates when promotion details change

- Integration with POS systems so promotions are validated before launch

- Product education tied to promotional calendars so budtenders know what they're selling

The Bottom Line

Your promotions are only as good as the frontline execution. And frontline execution depends entirely on clear, timely, complete communication.

The data is unambiguous: the majority of budtenders are operating without the information they need. They want notifications. They want lead time. They want details. They want to be prepared.

Give them the tools to succeed, and they'll drive the results you designed your promotions to achieve.

Because at the end of the day, the best promotional strategy in the world means nothing if the person standing across from your customer has no idea it exists.

Methodology: SparkPlug surveyed 556 budtenders across multiple U.S. states on November 12, 2025. Respondents represented a mix of independent dispensaries and multi-state operators. The survey included both quantitative multiple-choice questions and open-ended qualitative responses.

Want to see how top brands are solving the promotional communication gap? Learn more about SparkPlug Events